Why More Homeowners Are Giving Up Their Low Mortgage Rate (Even the 3% Ones)

If you’re like many homeowners, you may have thought:

“I want to move… but I don’t want to give up my 3% mortgage rate.”

Totally understandable. That rate has been one of your biggest financial wins. But here’s what more homeowners are realizing:

A great mortgage rate doesn’t fix a home that no longer fits your life.

Your needs evolve. Your lifestyle changes. And for many across Central Florida, it’s becoming clear: staying in a home that’s too small, too big, too far, or no longer practical can hold you back — even if the rate feels “too good to lose.”

That’s why more people are exploring options like luxury homes in Orlando or browsing Altamonte Springs homes for sale that better match their life today.

The Lock-In Effect Is Starting To Ease

Many homeowners have been frozen in place by something the experts call the lock-in effect. That's when you won't move because you don’t want to take on a higher rate on your next home loan. But data from Federal Housing Finance Agency (FHFA) shows the lock-in effect is slowly starting to ease for some people.

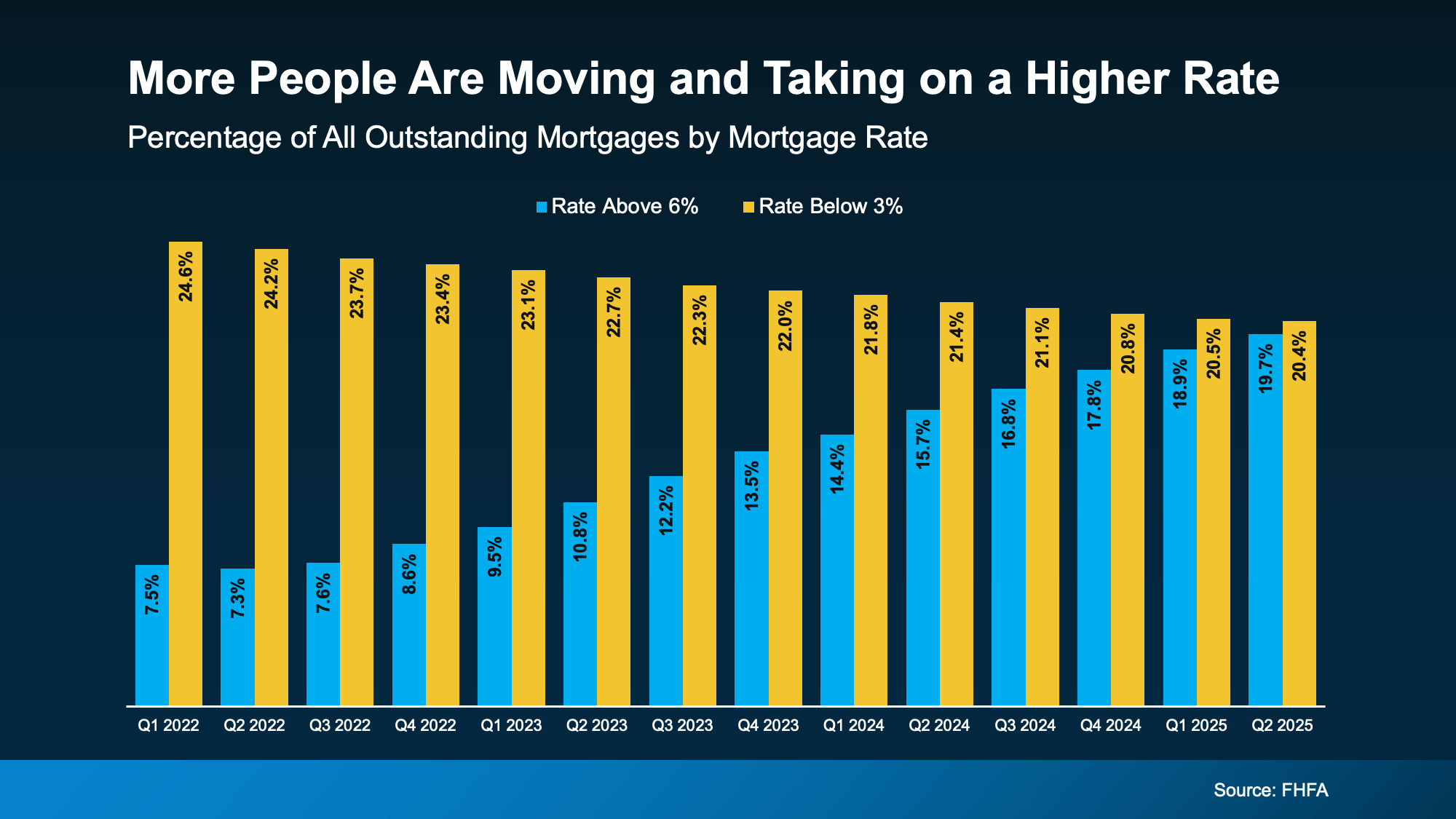

The share of homeowners with a mortgage rate below 3% (the yellow in the graph below) is slowly declining as more people move. And while some of the people with a rate over 6% are first-time buyers, the number of homeowners with a rate above 6% (the blue) is rising as others take on higher rates for their next home:

And while it may not seem that dramatic, it’s actually a pretty noteworthy shift. The share of mortgages with a rate above 6% just hit a 10-year high (see graph below). That shows more people are getting used to today’s rates as the new normal.

This shift can already be seen in markets throughout Central Florida. If you want to keep an eye on current neighborhoods, our Communities & Listings page shows updated homes and local market activity.

Why Are People Moving Now, Even With Higher Rates?

Life doesn’t wait. Families grow. Careers shift. Priorities change. A home that felt perfect five years ago may feel restrictive today.

For many, the decision to move is less about rates and more about what they need next. If you're exploring possibilities, our Home Buyer Guide and Search Homes Now tools can help you understand your options quickly.

The 5 Ds: What Truly Motivates Homeowners to Move

Economists at First American identify the top motivators for moving — and they apply to Central Florida homeowners just as much as anywhere else.

1. Diplomas

Career growth = more income = more buying power. Many upgrade into communities like Orlando or Altamonte Springs after advancing professionally.

2. Diapers

Growing families outgrow space — fast.

3. Divorce

A change in relationship status often requires new housing.

4. Downsizing

Empty nesters want lower maintenance and simplified living.

5. Death

Losing a loved one often brings the desire to move closer to family.

If you’re experiencing one of these life transitions, browsing homes for sale in Altamonte Springs or checking Orlando listings may be the first step toward a better lifestyle fit.

Are You Putting Your Life on Hold?

According to Realtor.com, nearly 2 in 3 homeowners thinking of selling have been considering it for more than a year.

That’s a long time to feel stuck in a home that no longer works.

Instead of asking:

“Should I move?”

A more important question may be:

“How much longer am I willing to stay in a home that doesn’t fit my life?”

If you’re unsure where to start, use our Home Valuation tool to estimate what your property is worth — then explore options that match your lifestyle today.

Why 2026 Could Be a Great Time to Move

Even though rates are higher than a few years ago:

They’ve dropped from their peaks

Forecasts show potential easing into 2026

Inventory in many areas is increasing

Buyers and sellers are re-entering the market

This means now could be a smart time to explore Orlando real estate or Altamonte Springs homes for sale — especially if your lifestyle needs are changing.

Remember:

A mortgage rate is temporary. Your daily quality of life is not.

Refinancing may be an option later.

You can’t refinance your way into more space, more comfort, or a better location.

Bottom Line

Life won’t wait for perfect timing — and your home shouldn’t hold you back. Whether you're craving more space, a better neighborhood, or a fresh start, Central Florida offers incredible opportunities.

Explore:

Ready to Explore Your Options?

Let’s talk about your goals, your timeline, and the lifestyle you want next.

👉 About Us

Your next chapter starts with the right home — let’s find it.