Rising Foreclosure Headlines Explained: What Today’s Housing Market Really Means for Central Florida Buyers and Sellers

Foreclosure headlines are rising, but the Central Florida housing market remains strong. Learn why today’s numbers are normal, what it means for houses for sale in Central Florida, and how trusted Central Florida Realtor Robert Michael Diaz helps buyers and sellers navigate with confidence.

If you’ve been following real estate news lately, you’ve probably seen attention-grabbing headlines claiming foreclosure activity has been rising for ten straight months. For many homeowners and buyers, especially those who remember the 2008 housing crash, those words can spark immediate concern.

But here’s the truth: rising foreclosure headlines are not a red flag for today’s housing market — especially not here in Central Florida.

As a region that continues to attract new residents, investors, and families, Central Florida real estate operates under very different conditions than the market did during the last crisis. To truly understand what’s happening, you have to look beyond the headlines and examine the data, context, and fundamentals that shape today’s housing environment.

That’s exactly what we’ll do in this in-depth guide — with expert insight from Robert Michael Diaz, a trusted name among real estate agents in Central Florida with more than three decades of experience.

Foreclosure Filings Are Up — But Context Changes Everything

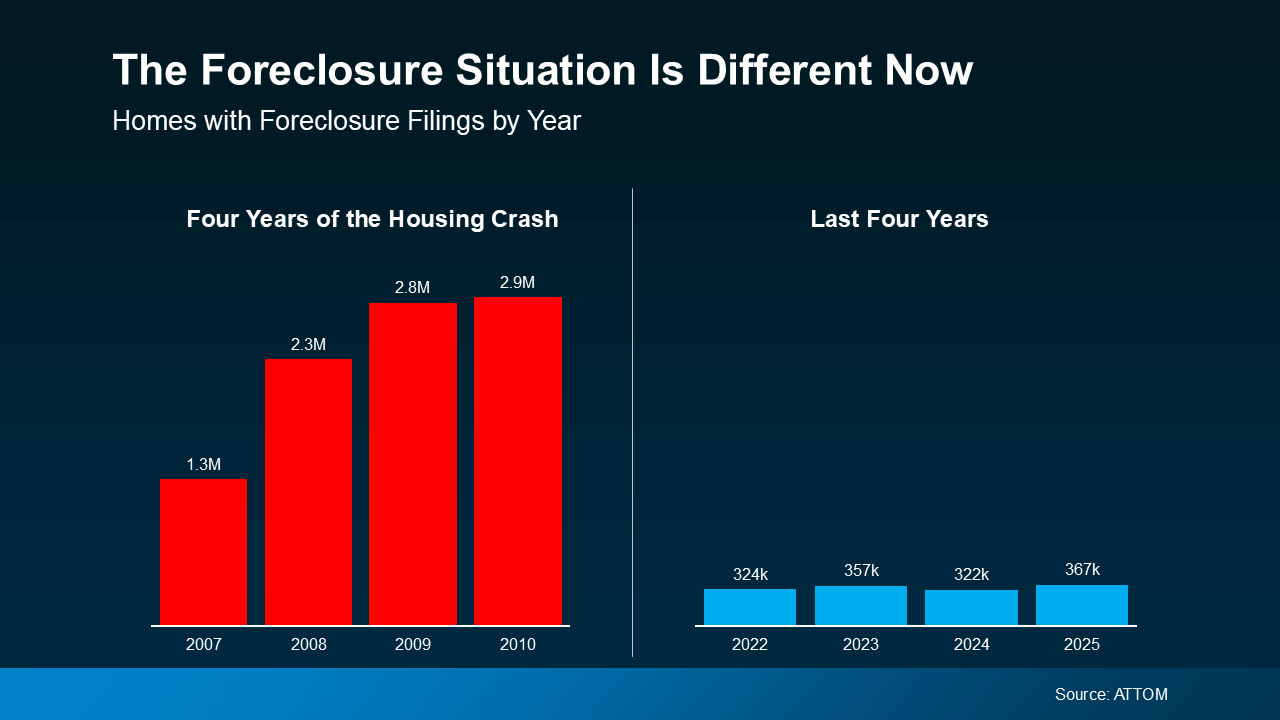

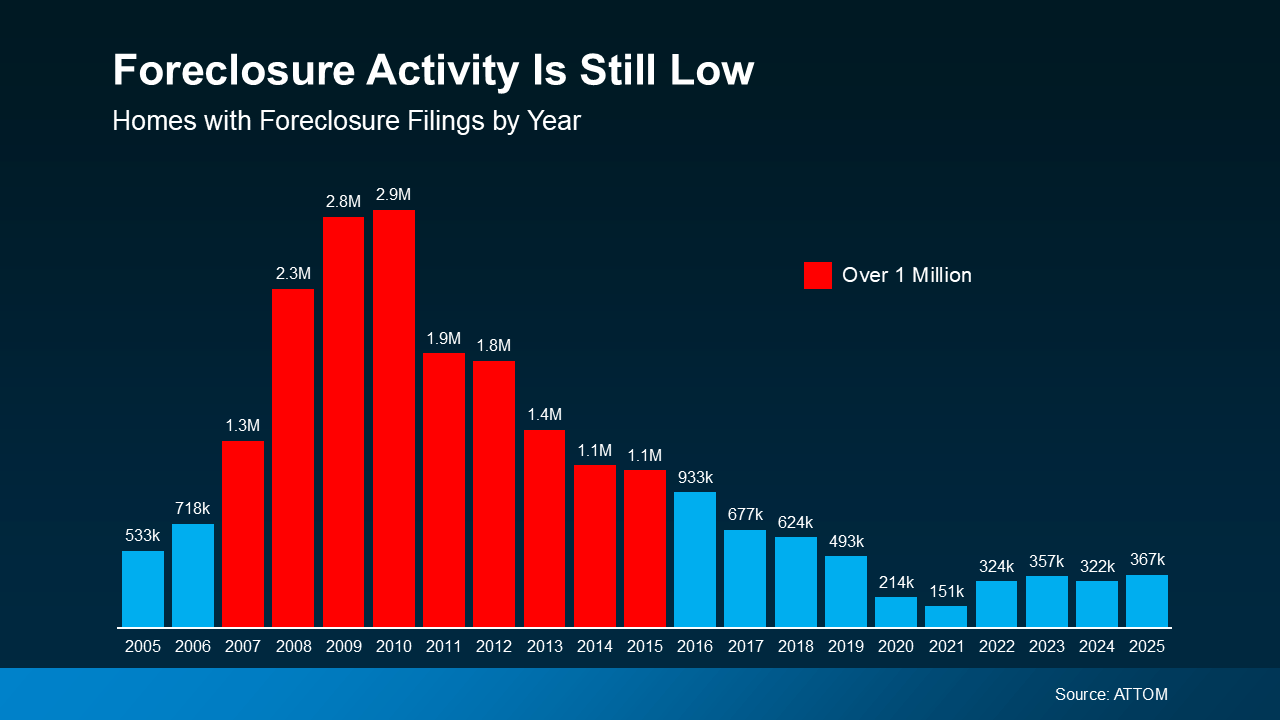

Yes, ATTOM data shows foreclosure filings are up 32% year-over-year. And that increase is going to sound dramatic. But context matters, and it doesn’t mean we’re headed for another crash. And the numbers prove it. Take a look at where we were during the last crash (the red in the graph below). And where we are now (the blue):

What many people don’t realize is that foreclosure activity was artificially low for several years following pandemic-era protections, forbearance programs, and emergency economic policies. As those temporary measures faded, the market began returning to more typical levels — a process experts call normalization.

When you compare today’s numbers to the years leading up to the 2008 crash, the difference is dramatic. During that period, foreclosure filings exceeded one million per year. Today’s levels are nowhere close.

Instead, current activity aligns closely with 2017–2019, which are widely considered the last truly “normal” years in housing.

As ATTOM CEO Rob Barber explains:

“Foreclosure activity increased in 2025, reflecting a continued normalization of the housing market… foreclosure activity remains well below pre-pandemic norms and a fraction of what we saw during the last housing crisis.”

In short, this is not a crisis — it’s a recalibration.

Why This Market Is Nothing Like 2008

Many fears around foreclosure stem from memories of the Great Recession. But structurally, today’s housing market is fundamentally different.

Here’s why this isn’t a repeat of 2008:

1. Lending Standards Are Stronger

Mortgage qualification rules today are far stricter. Borrowers are verified, documented, and vetted with greater care. Risky loan products that dominated the pre-2008 era simply aren’t common anymore.

2. Borrowers Are More Qualified

Today’s homeowners typically have stronger credit profiles and more stable financial footing. This reduces the likelihood of widespread defaults.

3. Homeowner Equity Is Historically High

This is the most important factor. Over the past five years, home prices have risen significantly across Central Florida. Most homeowners now have substantial equity, providing a powerful financial cushion.

In practical terms, this means homeowners facing hardship often have options:

Sell their home before foreclosure

Refinance or restructure

Walk away with cash instead of debt

That scenario is vastly different from 2008, when millions owed more than their homes were worth.

What This Means for Houses for Sale in Central Florida

If you’re shopping for houses for sale in Central Florida, this environment can actually present opportunities — without the risk many people fear.

We are not seeing a flood of distressed properties hitting the market. Instead, inventory remains balanced, demand remains steady, and prices are supported by strong fundamentals like population growth, job expansion, and lifestyle appeal.

For buyers:

Less panic means more thoughtful negotiations

Stable pricing helps protect long-term value

Professional guidance ensures smart decisions

For sellers:

Equity remains strong

Proper pricing and marketing matter more than ever

Strategic timing can maximize returns

This is where working with an experienced Central Florida Realtor Robert Michael makes all the difference.

Why Local Expertise Matters More Than Headlines

National headlines don’t account for local market realities. Central Florida has its own drivers — tourism, healthcare, technology, education, and ongoing migration from higher-cost states.

That’s why buyers and sellers rely on seasoned professionals like Robert Michael Diaz Broker – Owner of Robert Michael & Co – Real Estate Team. With 34 years of experience, a Multi-Billion Dollar Producer track record, and the discipline of a Gulf War Veteran, Robert brings clarity where others bring confusion.

Rather than reacting to fear-based news, he helps clients understand:

How data actually impacts their neighborhood

What trends matter now vs. what’s just noise

When to act — and when patience pays

The Bottom Line: Foreclosures Are Normalizing, Not Exploding

Yes, foreclosure activity has increased. But it’s still well within normal historical ranges and nowhere near danger zones. High equity, strong lending standards, and qualified borrowers are keeping the housing market resilient — especially in Central Florida.

The real danger isn’t the data — it’s misunderstanding it.

When headlines feel overwhelming, having a trusted advisor in your corner ensures you’re making decisions based on facts, not fear.

Your Trusted Central Florida Real Estate Resource

Robert Michael Diaz

Broker – Owner | RobertMichael.com

Robert Michael & Co – Real Estate Team

- 📍 Address: 618 E. South St. Ste 500, Orlando, FL 32801

- 📞 Tel: 407-545-2272

- 📱 Text: 941-676-9780

- 📧 Email: Robert@robertmichael.com

🕘 Hours:

Monday–Friday: 9:00 AM – 7:00 PM

Saturday: By appointment only

Whether you’re buying, selling, or simply seeking clarity about the market, working with one of the most respected real estate agents in Central Florida gives you the confidence to move forward wisely.

If foreclosure headlines have raised questions, reach out today — and get the full picture before making your next move.